The Currency Pairs market, is the largest and most liquid financial market globally, with an average daily trading volume exceeding $7.5 trillion as of 2022. This makes it far bigger than other markets like stocks and commodities. It operates 24 hours a day, five days a week, across different time zones, providing ample opportunities for traders.

How Currency Pairs Trading Works

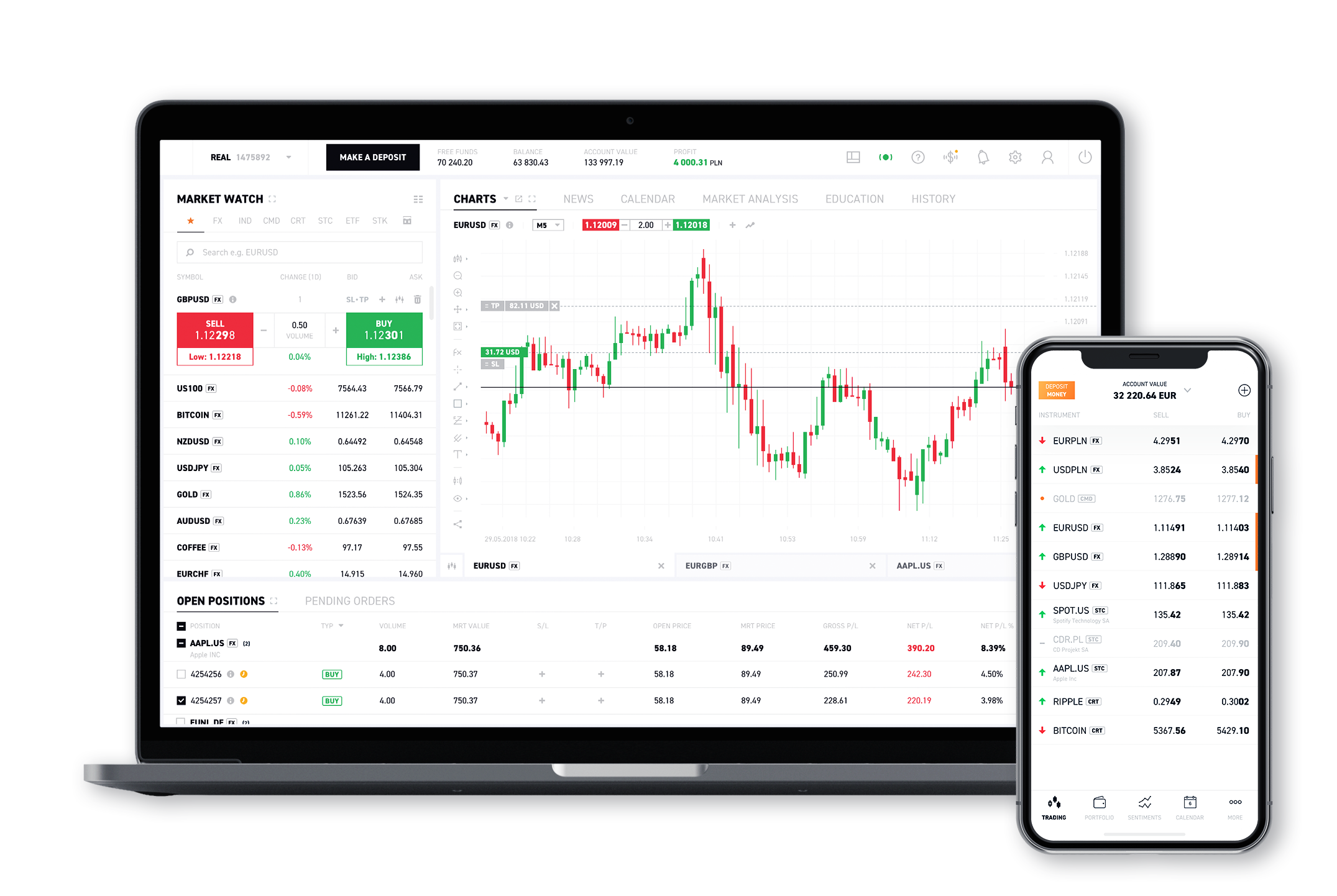

Currency Pairs trading involves buying one currency while simultaneously selling another. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/USD (British Pound/US Dollar). The first currency in the pair is the base currency, and the second is the quote currency. The price of the pair tells you how much of the quote currency is needed to buy one unit of the base currency.Currency Pairs trading involves buying one currency while simultaneously selling another. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/USD (British Pound/US Dollar). The first currency in the pair is the base currency, and the second is the quote currency. The price of the pair tells you how much of the quote currency is needed to buy one unit of the base currency.

For instance, if the EUR/USD price is quoted as 1.11361, it means €1 is equivalent to $1.11361. Traders can go long (buy) if they expect the base currency to rise in value or go short (sell) if they believe it will fall. If the currency moves as anticipated, they profit from the change; if not, they incur a loss.

Market Types and Participants

Currency Pairs trading is done in various segments such as Spot FX, Forward Derivatives, Futures, and CFDs (Contracts for Difference), with CFDs being the most popular for retail traders. This market is over-the-counter (OTC), meaning it’s not traded on a centralized exchange, and each major international bank provides its own price quotes, with the spot market acting as a reference.